美圖公司: 業績前瞻:AI浪潮下主營穩健增長,卡位C端應用持續驗證產品力

发布时间:2024-03-14 23:23:03

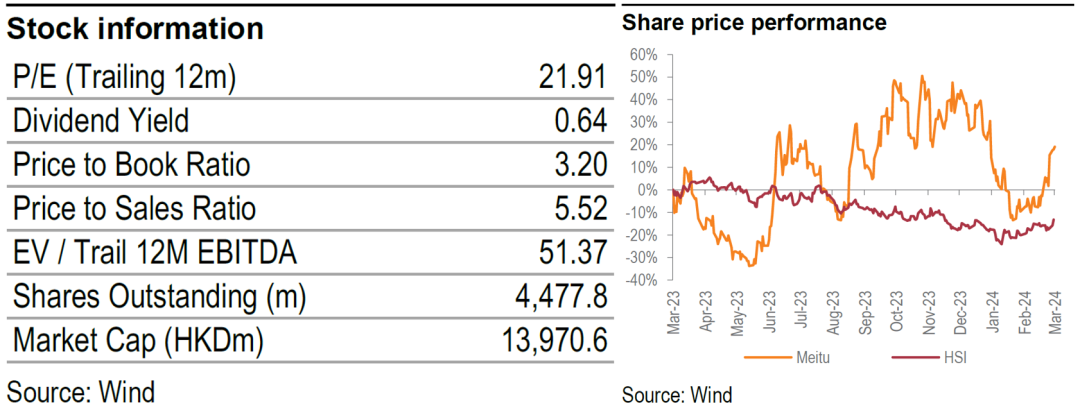

Meitu

(1357 HK)

業績前瞻:AI浪潮下主營穩健增長,卡位C端應用持續驗證產品力

2023E preliminary results: AI drove steady core growth as B2C apps validate Meitu’s product prowess

BUY (maintain) |

投資要點/Investment Thesis

投资要点/Investment Thesis

事件:美圖公司發佈業績盈利預喜公告,預計2023年12月31日止年度根據非國際財務報告準則錄得約人民幣3.30~3.70億元歸母經調整淨利潤,同比2022年12月31日止年度約人民幣1.11億元增長約200%至230%。

Preliminary 2023E results: 200% growth in non-IFRS adjusted net profit

Meitu announced preliminary accounting data for 2023E, indicating earnings growth, and guides RMB330m-370m in adjusted net profit in non-IFRS terms, representing a 200-230% increase from about RMB111m in 2022. It attributes the following growth catalysts:

•Productive imaging solutions: demand grew unexpectedly as user payment penetration deepened; and

•Ex-mainland subscriber growth: the markets outside of China grew steadily as the company’s globalization strategy took off.

23年業績增長核心貢獻主要系:1)生產力相關影像產品需求的超預期增長提升用戶付費滲透率;2)全球化策略下中國內地以外訂閱用戶的穩步增長。此外我們前期也多次強調美圖公司在商業模式成功切換、創始人重新出任董事長後,策略層面全面聚焦主業已兌現強勁的主業收入增長,同時公司在C端的競爭格局優勢或被低估,依託於長期積累的經驗和用戶有望在AI時代工具軟件加速整合和革新的過程中重新搶佔原有專業工具軟件市場。

Other catalysts:

•Core business refocus: with the return of Meitu’s founder as chairman, the change in business model has been a key driver. As we have highlighted in previous reports, the strategic comprehensive refocus on core business strength has led to strong core revenue growth.

•Consumer edge empowers pro segment: we believe Meitu’s competitive edge in the B2C business is underrated. With its long experience, it has amassed a rich pool of users, which we expect will help recapture its positioning in the professional segment as it integrates AI tool software and innovations.

公司業績雙擎驅動,AI加持下有望持續提升經營槓桿:展望 24-25 年我們認爲自上而下設定的AIGC策略和聚焦主業工具軟件的策略轉向有望爲美圖公司帶來收入和利潤的持續增長,在短期產品定價策略優化和全球化策略+AIGC新產品的推動下,公司的訂閱業務經營槓桿有望發力,帶動公司24-25年業績持續超預期。

AI augments twin business engines; we expect operating leverage will improve

Ahead in 2024-25E, we expect Meitu’s top-down AIGC strategy, on top of its strategic core refocus to tool software, will sustain revenue and profit growth. The refinement of short-term product pricing and globalization strategies, along with its new AIGC products, would increase operating leverage in the subscription business and could continue to drive outperformance vs expectations in 2024-25E.

我們認爲生成式 AI圖像賽道的最大機會可能來自於1)素材庫(圖像、字體、AI模型)和2)輕量化工具軟件帶來的工作流升級。素材庫方面公司聯手國內最大設計師平臺站酷,重視設計師資產在生成式AI時代的價值提升;工作流方面圍繞美圖設計室爲核心,通過生成式AI加速B端工具軟件的輕量化和技術平權,基於此我們認爲其模型升級的方向將持續向輕量化的專業工具軟件靠齊,並逐步在基礎設計功能方面有望逐步取代一部分傳統專業設計工具和輕量化工具軟件的交叉覆蓋市場。

We believe these are the biggest opportunities in the generative AI imaging tool business:

• Materials library: images, fonts, AI models

• Workflow upgrades: lean and mean tool software.

Materials library: Meitu joined forces with ZCool, China’s largest designer platform, to add value to its designer assets with generative AI. Workflow is driven from the hub of Meitu Design Studio, while generative AI incorporates lean B2B tool software with advanced tech. Hence, we expect future model upgrades will feature lean professional tool software and we expect they will gradually replace some of the basic design functions currently used in the cross-coverage market for traditional professional design tools and lean software tools.

大模型對於美圖的顛覆邏輯難以迅速證實:在任意細分領域持續優化的前提除了模型能力跨代式超越外,細分行業的數據依然十分重要,尤其是在美顏這個顆粒度極高的細分子行業,因此即使美顏賽道進入AI時代後出現全新的交互模式,美圖公司卡位依然具備相對優勢。因此與主營業務大部分To B的工具軟件企業略有不同,我們認爲美圖在生成式AI上的卡位更近似於Canva,即或主要受益於社交媒體營銷崛起和創作者經濟。在生成式AI時代到來後,我們認爲公司受益於長期深耕圖像顏值賽道總結出的產品方法論和數據沉澱,同時具備合規且生成式能力持續迭代的AI大模型,因此公司在細分賽道具備相對競爭優勢。

Changing model for the AI market: Meitu has the best vantage in beauty imaging

Well positioned for AI: we reckon the ongoing process of segmental market optimization presupposes that model capabilities undergo a cross-generational transcendence. Data is crucial, especially in a tightly niche industry such as image beautification software. Hence, even if new AI interactive models emerge in this market, we believe Meitu already commands the competitive vantage.

Mature methodology and rich data: unlike other tool software providers that predominantly ply the B2B market, Meitu’s positioning in generative AI is more similar to that of Canva and would mainly benefit with the rise of social media marketing and a creator economy. As generative AI gains traction, we believe Meitu will leverage its product methodology and rich data amassed from its long experience in imaging beautification. Its AI model is compliant with regulations and has generative capabilities that can be iterated, giving the company a competitive advantage in this segment.

投資建議/Investment Ideas

投資建議:我們依舊持續看好2024年是AI與工具軟件結合的大年,作爲細分顏值賽道的頭部產品,訂閱會員滲透率、會員轉化率有望持續提升,且2022年底已驗證(AI動漫);生活場景之外我們認爲美圖公司在C端的競爭格局優勢或被低估,在本輪生成式AI和工具軟件的結合機遇中,美圖或有望總結過去輕量化工具軟件經營並傳導至B端市場,建立輕量化工具軟件的體驗優勢。我們認爲在逐步提升生成式AI能力的背景下,美圖有望驗證其產品力,同時發佈盈利預喜有望持續保持向市場傳遞正向信息。我們預計公司23/24年營收爲28.78/37.03億元,維持“買入”評級。

Valuation and risks

We continue to anticipate 2024E will be a great year for Meitu on the combination of AI and tool software growth. As market leader of beautification software, we expect its subscription membership penetration and membership conversion rates will keep rising, after having been validated by end-2022 (on AI anime). Beyond daily life scenarios, we believe Meitu’s B2C competitive advantage is underrated. Amid current opportunities that combine generative AI and tool software, Meitu can transfer its experience and expertise in lean tool software operations to the B2B market. While it gradually acquires generative AI capability, we expect Meitu will be able to verify its product strength and its profit forecasts could continue to deliver positive news flow in the market. We forecast revenue at RMB2.88bn/3.70bn in 2023/24E and maintain our BUY rating.

風險提示:1)大模型效果不及預期風險;2)工具軟件市場競爭加劇;3)B端及海外市場拓展不及預期;4)業績預告僅爲初步覈算數據,準確數據請以正式披露的年報爲準。

Risks include: weaker-than-expected LLM impact; intensifying competition in tool software; and the B2B and global market expansion falling short of expectations. Note: Meitu’s preliminary accounting data are subject to the release of its final 2023 results.

Email: equity@tfisec.com

TFI research report website:

(pls scan the QR code)

本文件由天風國際證券集團有限公司, 天風國際證券與期貨有限公司(證監會中央編號:BAV573)及天風國際資產管理有限公司(證監會中央編號:ASF056)(合稱“天風國際集團”)編制,所載資料可能以若干假設為基礎,僅供作非商業用途及參考之用途,會因經濟、市場及其他情況而隨時更改而毋須另行通知。任何媒體、網站或個人未經授權不得轉載、連結、轉貼或以其他方式複製發表本檔及任何內容。已獲授權者,在使用本檔或任何內容時必須注明稿件來源於天風國際集團,並承諾遵守相關法例及一切使用的國際慣例,不為任何非法目的或以任何非法方式使用本檔,違者將依法追究相關法律責任。本檔所引用之資料或資料可能得自協力廠商,天風國際集團將盡可能確認資料來源之可靠性,但天風國際集團並不對協力廠商所提供資料或資料之準確性負責。且天風國際集團不會就本檔所載任何資料、預測及/或意見的公平性、準確性、時限性、完整性或正確性,以及任何該等預測及/或意見所依據的基準作出任何明文或暗示的保證、陳述、擔保或承諾而負責或承擔任何法律責任。本檔中如有類似前瞻性陳述之內容,此等內容或陳述不得視為對任何將來表現之保證,且應注意實際情況或發展可能與該等陳述有重大落差。本檔並非及不應被視為邀約、招攬、邀請、建議買賣任何投資產品或投資決策之依據,亦不應被詮釋為專業意見。閱覽本文件的人士或在作出任何投資決策前,應完全瞭解其風險以及有關法律、賦稅及會計的特點及後果,並根據個人的情況決定投資是否切合個人的投資目標,以及能否承擔有關風險,必要時應尋求適當的專業意見。投資涉及風險。敬請投資者注意,證券及投資的價值可升亦可跌,過往的表現不一定可以預示日後的表現。在若干國家,傳閱及分派本檔的方式可能受法律或規例所限制。獲取本檔的人士須知悉及遵守該等限制。